Weather Report

12.45℃

Thursday, April 25

● To promote exports, we will among others: ○ expand our productive capacity in the real sector of the economy and actively encourage the consumption of locally produced rice, poultry, vegetable oil and fruit juices, ceramic tiles among others; ● To pursue efficiency in Government expenditures, we will among others: ○ Implement the Government directives on expenditure measures; ○ Integrate public procurement approval processes with GIFMIS to ensure that projects approved are aligned with budget allocation; ○ Review key government programmes to reflect relevance, promote efficiency, and ensure value for money; and ○ Review the efficiency of Statutory Funds ● To implement structural and public sector reform, we will among others: ○ Impose a debt limit on non-concessional financing; ○ Undertake major structural reforms in the Public Sector by reviewing the operations of 36 State-owned Enterprises, 8 Special Purpose Vehicles, 90 Joint Venture Companies, 38 Regulatory institutions, 68 Statutory Bodies and 6 Subvented Agencies; ○ Enforce compliance with legal and regulatory framework on foreign exchange; ○ Initiate measures to overhaul the tax structures in the extractive industry; ○ Expand the gold purchase programme by Bank of Ghana to support FX Reserve accumulation, promote an LBMA certified gold refinery in Ghana and promote local currency stability; ● To safeguard the social protection programmes, we will among others: ○ Expand social protection programmes such as LEAP, School Feeding, and NHIS for the vulnerable and socially excluded.

Progress on the following roads, among other have achieved significant progress: ● Upgrading of Navrongo – Naga Road ● Upgrading of Wa-Bulenga-Yaala Road ● Upgrading of Salaga – Ekumdipe – Kpandai Road ● Kpandai – Nkanchina Road (10.8km) ● Rehabilitation of Atebubu – Kwame Danso Roads ● Upgrading of Anwiankwanta – Obuasi Road ● Rehabilitation Of New Abirem – Ofoasekuma Road ● Upgrading of Sefwi Wiawso – Akontombra Road ● Upgrading of Akrodie – Sayereso Road ● Rehabilitation of selected roads in Greater Accra.

To better assess the macroeconomic developments for the first three quarters of the year, permit me to restate the macroeconomic targets set for 2022 as presented in the 2022 Mid-Year Fiscal Policy Review: • Overall Real GDP growth of 3.7 percent; • Non-Oil Real GDP Growth rate of 4.3 percent; • End-period inflation of 28.5 percent; • Overall fiscal deficit of 6.6 percent of GDP; • Primary surplus of 0.4 percent of GDP; and • Gross International Reserves sufficient to cover at least three and half months of imports of goods and services.

; ● A freeze on new tax waivers for foreign companies and review of tax exemptions for free zone, mining, oil and gas companies; ● A hiring freeze for civil and public servants ● No new government agencies shall be established in 2023; ● There shall be no hampers for 2022; ● There shall be no printing of diaries, notepads, calendars and other promotional merchandise by MDAs, MMDAs and SOEs for 2024; ● All non-critical project must be suspended for 2023 Financial year CONCLUSION 126.

We plan to: ● Aggressively mobilise domestic revenue; ● Boost local productive capacity; ● Promote a diversified and vibrant value-added export sector; ● Streamline expenditures; ● Protect the poor and vulnerable; ● Expand digital and physical infrastructure; and ● Implement structural and public sector reforms.

To this end, the programme will: ● work with DBG to provide funding to interested and targeted farmers ● support MoFA to adopt and deploy the farmer registration database for the farmer input subsidy programme to enhance efficiency; ● support the Ministry of Communication and Digitalisation (MoCD) to establish a tech hub to improve knowledge in Technology and innovation by the youth, in collaboration with the University of Ghana; ● ensure the operationalisation of the Foundry under a sustainable private sector management framework; ● provide interest rate subsidies and direct financing; including supporting prioritised sectors in the rural economy through the ARB Apex Bank and its network of banks as agreed under the AfDB-supported Post-COVID Skills and Productivity Enhancement Project.

Mr.

Speaker, contract works under the Master Project Support Agreement (MPSA) with Sinohydro Corporation Limited are stages of completion: ● Tamale Interchange Project (100%) ● Western Region and Cape Coast Inner City Roads (100%) ● Upgrading of Selected Feeder Roads in Ashanti and Western Regions (100%) ● Construction of Hohoe-Jasikan–Dodi-Pepesu (100%) ● PTC Roundabout Interchange Project, Takoradi (60%) ● Sunyani Inner City Roads (63%) ● Kumasi Inner City Roads (10%) 116.

Mr.

Speaker, we know that we have to: ● Keep the lights on at the cost of US$1billion annually; ● keep the hospitals running and ensure that the over 15.5m Ghanaians on NHIS are properly catered for; ● Keep our schools running and pay the over 300,000 teachers every month; ● Keep our hospitals running and pay the over 119,000 nurses every month; ● Keep the law courts open and ensure timely access to justice; and ● Keep the local assemblies working to deliver essential social services to our people.

Completed projects include: ● Upgrading of Golokwati-Wli Road; ● Upgrading of Nsuta – Beposo, Lot 3; ● Rehabilitation of Nkonya Wrumpong – Kwamikrom; ● Partial Reconstruction of Bawjiase – Adeiso; and ● Resealing of Tamale – Salaga Road – Lot.

interchanges at Dufor Adidome and Asikuma Junction; ● Kasoa – Cape Coast Dualisation; ● Dualization of Sekondi and Adiembra Roads; ● Takoradi -Agona-Nkwanta- Apemanim ● Construction of Bridge over the Volta River at Volivo; ● Buipe, Yapei and Daboya Bridges; ● Adawso-Ekyi Amanfrom Bridge; and ● Dikpe, Iture and Ankobra Bridges.

For example, the discount rate on the 91-day instrument has increased to 32.5 percent as at today from 12.5 percent in December 2021; • The Public Debt-to-GDP ratio stood at 75.9 percent at the end of September 2022, up from 76.7 percent at the end of December 2021.

● To aggressively mobilize domestic revenue, we will among others: ➢ Increase the VAT rate by 2.5 percent to directly support our roads and digitalization agenda; ➢ Fast-track the implementation of the Unified Property Rate Platform programme in 2023; and ➢ Review the E-Levy Act and more specifically, reduce the headline rate from 1.5% to one percent (1%) of the transaction value as well as the removal of the daily threshold.

● To boost local productive capacity, we will among others: ○ cut the imports of public sector institutions that rely on imports either for inputs or consumption by 50% and will work with the Ghana Audit Service and the Internal Audit Agency to ensure compliance; ○ support the aggressive production of strategic substitutes, including the list disclosed at the President’s last address to the nation; ○ Support large-scale agriculture and agribusinesses interventions through the Development Bank Ghana and ADB Bank; ○ introduce policies for the protection and incubation newly formed domestic industries to allow them to make the goods produced here competitive for local consumption and also for exports.

Mr.

Speaker, provisional GDP data from Ghana Statistical Service (GSS) published in September 2022 indicate that overall Real GDP for the first half of 2022 recorded an average year-on-year growth of 4.0 percent (3.4 percent in Q1 2022 and 4.8 percent in Q2 2022 respectively).

Accordingly, all government institutions should submit a travel plan for the year 2023 by mid-December of all expected travels to the Chief of Staff; ● As far as possible, meetings and workshops should be done within the official environment or government facilities; ● Government sponsored external training and Staff Development activities at the Office of the President, Ministries and SOEs must be put on hold for the 2023 financial year; ● Reduction of expenditure on appointments including salary freezes together with suspension of certain allowances like housing, utilities and clothing, etc.

Mr.

Speaker, Total Revenue and Grants amounted to GH¢65,399 million (11.0 percent of GDP), compared with a target of GH¢67,307 (11.4 percent of GDP) and the GH¢49,108 million (10.7 percent of GDP) recorded in the corresponding period in 2021.

Mr.

Speaker, Total Expenditure (including arrears clearance and discrepancy) for the period amounted to GH¢109,421 million (18.5 percent of GDP), above the target of GH¢103,992 million (17.6 percent of GDP) by 5.2 percent.

These include: ● Construction of Accra – Kumasi Road: Anyinam Bypass; ● Construction of Accra – Kumasi Road: Konongo Bypass; ● Construction of Adidome – Asikuma Junction and Asutsuare – Aveyime including 2No.

Overall, debt accumulation increased from 20.7 percent in 2021 to 32.7 percent as at end September 2022, reflecting the impact of the depreciation of the Ghana cedi on the external debt side.

This was on the back of revisions in GDP projections, adjustment in the expected yield from the 2022 revenue measures, adjustments to reflect the 30 percent discretionary expenditure cuts, adjustment in interest payments, and adjustments in the allocation for compensation of employees to incorporate a 15 percent Cost of Living Allowance (COLA), adjustment in exchange rate on account of higher depreciation, and adjustment to the Benchmark Crude oil price.

In Sub-Saharan Africa, growth is expected to slow down to 3.6 percent in 2022 and 3.7 percent in 2023, from 4.7 percent in 2021 due to low investment and a worsening trade balance.

Mr.

Speaker, Domestic Revenue for the period amounted to GH¢64,601million (10.9 percent of GDP), falling below the target of GH¢66,503 million (11.2 percent of GDP) by 2.9 percent.

The domestic debt component is GH¢195,657.60 million, which is 31.79 percent of GDP, whilst external debt is GH¢271,713.71 million, representing 44.15 percent of GDP.

Domestic debt as a share of total public debt reduced from 51.6 percent in 2021 to 41.9 percent as at end September 2022.

Compensation of Employees amounted to GH¢27,146 million (4.6 percent of GDP), 2.9 percent below the budgetary provision of GH¢27,947 million (4.7 percent of GDP).

Interest Payments for the period amounted to GH¢32,101 million (5.4 percent of GDP), against the target of GH¢30,890 million (5.2 percent of GDP) reflecting the higher cost of borrowing and the adverse impact of the currency depreciation on external interest.

Mr.

Speaker, Total Revenue and Grants is projected at GH¢143,956 million (18.0% of GDP) and is underpinned by permanent revenue measures – largely Tax revenue measures – amounting to 1.35 percent of GDP as outlined in the revenue measures.

Inflation which we managed to bring down from 15.4 percent at the end of 2016 to 7.9 percent at the end of 2019 and remained in single digits till the pandemic hit in March 2020 is now 40.4 percent.

Economic growth in Emerging Markets and Developing Economies is expected to slow down from 6.7 percent in 2021 to 3.7 percent in 2022, with a similar pattern expected in 2023.

I also respectfully submit to this House the following statutory reports: ● The 2022 Annual Report on the Petroleum Funds, pursuant to Section 48 of the Petroleum Revenue Management Act, 2011 (Act 815), (as amended); and ● The 2022 Report on the Utilisation of the African Union Levies, pursuant to Section 7 of the African Union Import Levies Act, 2017 (Act 952).

The end-September 2022 provisional figures indicate that total gross public debt stood at GH¢467,371.31 million (US$48,871.34 million), representing approximately 75.9 percent of GDP.

Additionally, works on the reconstruction of Bechem – Techimantia – Akomadan and Agona Nkwanta – Tarkwa roads are at 21 percent and 7 percent completion, respectively.

Compared to the average 7 percent average annual depreciation of the Cedi between 2017 and 2021, the current year’s depreciation, which is driving the high costs of goods and services for everyone, is clearly an aberration – a very expensive one.

The outturn for Total Revenue and Grants represents a shortfall of 2.8 percent compared to the period’s target and year-on-year growth of 33.2 percent.

The fiscal deficit target was revised to 6.6 percent of GDP down from the 7.4 percent set in the 2022 Budget.

Mr.

Speaker, based on the estimates for Total Revenue & Grants and Total Expenditure (including arrears clearance), the overall Budget balance to be financed is a fiscal deficit of GH¢61,475 million, equivalent to 7.7 percent of GDP.

• Gross International Reserves (GIR) stood at US$6,591.8 million, equivalent to 2.9 months of imports cover, at the end of September 2022 from a stock position of US$9,695.2 million (equivalent to 4.3 months imports cover) at the end of December 2021.

Mr.

Speaker, a launch for the District Entrepreneurship Programme (DEP) component of the programme was held on 14th November, 2022 and it is expected that the launch of the Commercial component of the Programme will occur by the end of 2022 to enable qualified beneficiaries access support.

Mr.

Speaker, the external debt as a percentage of the total debt stock is 58.1 percent as at end September 2022.

Mr.

Speaker, Government and the IMF have agreed on programme objectives, a preliminary fiscal adjustment path, debt strategy and financing required for the programme to be in line with the Government’s Post-COVID-19 Programme for Economic Growth (PC-PEG).

Inflation in Emerging and Developing Economies has also risen from an average 5.9 percent in 2021 to 9.9 percent in 2022.

Reduce the threshold on earmarked funds from the current 25 percent of Tax Revenue to 17.5 percent of Tax Revenues; ii.

As I indicated earlier, these developments have manifested through rapid exchange rate depreciation, high inflation, unsustainable debt burden, fiscal stress and external sector shocks, among others, despite the monetary and fiscal policy interventions that were deployed in the first three quarters of the year.

The outturn, however, represents a year-on-year growth of 34.0 percent and constituted 98.8 percent of Total Revenue and Grants.

Non-Oil GDP expanded by 4.1 percent and 6.2 percent in the first and second quarters in 2022, respectively.

Mr.

Speaker, provisional debt data as at end September 2022 shows a significant increase in Ghana’s public debt largely due to exogeneous factors.

The fiscal deficit for the period was financed mainly from domestic sources amounting to GH¢37,491 million (6.3% of GDP), accounting for 85.2 percent of the total financing.

A successful passage of the 2023 budget, a successful conclusion of negotiations with the IMF; and, making Ghana’s performance in Qatar 2022, the most successful that is winning the Cup not only for the country but for any African side on the World Cup stage, will, I dare say, bring this most challenging year to a very successful end.

Similarly, the primary balance target was revised upwards to a surplus of 0.4 percent of GDP from a surplus of 0.1 percent.

In the immediate term, we will work towards securing an agreement with the International Monetary Fund, execute the debt exchange programme, improve the management of foreign exchange, and support our local productive capacity for food security.

Accordingly, 50% of the previous years (2022) budget allocation for fuel shall be earmarked for official business pertaining to MDAs, MMDAs and SOEs; ● A ban on the use of V8s/V6s or its equivalent except for cross country travel.

Mr.

Speaker, Government through the Development Bank Ghana (DBG) has established a GH¢500 million special credit programme: the DBG Emergency Economic Programme (DEEP) to support businesses in the agribusiness value chain over the next five years.

2 percent in September and 33.9 percent in August.

The PC-PEG is Government’s blueprint to restore macroeconomic stability, promote debt sustainability, sustain economic recovery and support structural reforms.

Foreign financing for the period amounted to GH¢6,531 million (1.1% of GDP) and accounted for the remaining 14.8 percent of the financing.

To this end, we will implement a debt exchange programme to address the challenges identified in the portfolio in collaboration with all relevant stakeholders including the Ghanaian public, investor community and development partners.

The sustainability of our debt has been continuously affected by the negative impact of exchange rate depreciation, particularly on external debt, as well as the crystallization of significant contingent liabilities in recent years.

Government is therefore taking active steps to address the impact of these economic shocks on Ghanaians through the seven-point agenda to restore macro- economic stability and accelerate our economic transformation as articulated in the Post-COVID-19 Programme for Economic Growth.

Ours is a country with real prospects and the challenges notwithstanding, Ghana will rise again, and my faith is premised on the fact that a lot has already been achieved, especially over the course of the Fourth Republic and our policy, as outlined in this budget to reset the economy, if supported will ensure that, indeed, we have not wasted the current global crisis, but used it to make our economy stronger and the progress and prosperity of our people even more assured.

And, to the Minority caucus of the National Democratic Congress in Parliament, I thank you, for your decision yesterday to participate fully in the process of passing this budget and, to quote, you stressed how “also mindful” you are “of the timeliness regarding the IMF negotiations and the crucial role a timely presentation of the 2023 budget will play in the advancement” of Ghana’s case in the negotiations with the Fund.

Mr.

Speaker, the fiscal operations for the period resulted in an overall budget deficit of GH¢44,022 million (7.4% of GDP), against a target of GH¢36,684 million (6.2% of GDP).

Mr.

Speaker, I wish to notify you that, Budget items such as Interest Payments, Amortisation and Financing will be adjusted accordingly once Government’s debt management strategy and financing to be provided by international partners in the context of the Fund-supported programme have been finalised.

For the avoidance of doubt, purchase of new vehicles shall be restricted to locally assembled vehicles; ● Only essential official foreign travel across government including SOEs shall be allowed.

Mr.

Speaker, the 2022 Mid-Year Fiscal Policy Review revised the 2022 fiscal framework against the backdrop of unfavourable global and domestic developments.

• The latest data indicates that headline inflation accelerated to 40.4 percent in October 2022, from 37.

Works are ongoing on the rehabilitation of Assin Fosu – Assin Praso road including the dualisation of 1.2km of Assin Fosu township roads into a 4-lane carriageway is at 53 percent.

The corresponding Primary balance is a deficit of GH¢8,925 million, equivalent to 1.1 percent of GDP.

• The Monetary Policy Rate has increased by 1,000 basis points (from 14.5% to 24.5%) since the beginning year as the Central Bank deployed its monetary policy tools to anchor inflation expectations; • Developments on the money market broadly showed rising interest rates across the yield curve.

Mr.

Speaker, provisional data on Government fiscal operations for January – September 2022 shows a shortfall in revenue performance and a faster execution of expenditures.

Mr.

Speaker, as a first step toward expenditure rationalisation, Government has approved the following directives which takes effect from January, 2023: ● All MDAs, MMDAs and SOEs are directed to reduce fuel allocations to Political Appointees and heads of MDAs, MMDAs and SOEs by 50%.

The corresponding primary balance for the period was a deficit of GH¢9,597 million (1.6% of GDP), against a deficit target of GH¢5,794 million (1.0% of GDP).

The Wage bill constituted 91.3 percent of the total Compensation and amounted to GH¢24,734 million.

This resulted in an overall budget deficit of GH¢41,699 million (7.0% of GDP), against a programmed deficit target of GH¢36,684 million (6.2% of GDP).

This contributed to the depreciation of the cedi, which has lost about 53.8 percent of its value since the beginning of the year.

This estimate shows a contraction of 0.3 percentage points of GDP in primary expenditures (commitment basis) compared to the projected outturn in 2022 and a demonstration of Government’s resolve to consolidate its public finances.

We currently have the capacity as a country to locally produce items that account for about 45 percent of the value of our annual imports.

The programme was successfully piloted with 70 beneficiaries and an amount of GH¢1.98 million was disbursed to support youth-led (below the age of 40 years) SMEs in poultry, agro processing, ICT, textiles, and food processing sectors.

Indeed, our stock of debt has increased by GHc93 billion this year alone due to the depreciation of the cedi since the beginning of 2022.

This will enable us to generate substantial revenue, create needed fiscal space for the provision of essential public services and facilitate the implementation of the PC-PEG programme to revitalise and transform the economy.

All government vehicles would be registered with GV green number plates from January 2023; ● Limited budgetary allocation for the purchase of vehicles.

As at 23rd November, 2022, the Ghana cedi depreciated cumulatively by 54.2 percent against the US Dollar.

Domestic Interest Payments constituted 78 percent of total Interest Payments for the period.

Mr.

Speaker, I also wish to express the deep appreciation of Government to the various stakeholders, including Employers’ Associations, Labour Unions, Civil Society, Faith- Based Organizations, Association of Ghana Industries, Ghana Union of Traders Association, Bankers, Academia and Think-Tanks for the support we have received throughout the year, as well as the inputs that have informed and enriched our policy choices.

Mr.

Speaker, the high food prices and pressures on the local currency validates the current focus of the GhanaCARES Programme to bolster the productive and export capacity of the private sector.

Mr.

Speaker, based on the overall macroeconomic objectives and the medium- term targets, the following macroeconomic targets are set for the 2023 fiscal year: i.

Mr.

Speaker, overall, the project is about 95 percent complete and will ensure safe launching and landing of artisanal fishing canoes and promote hygienic environmental conditions.

We are now embarking on a journey to fundamentally reposition our economy with the Post-COVID-19 Programme for Economic Growth (PC-PEG), to be supported by the IMF, World Bank and other friendly sovereigns and the private sector (domestic and international), as our blueprint.

Mr.

Speaker, the present economic challenges have heightened the need to transform our economy through a renewed focus on boosting local capacity for increased export promotion, to expand job creation while protecting the vulnerable.

Mr.

Speaker, a year ago, I came to present a Budget with significant revenue measures to tackle our fiscal difficulties, finance the transformative agenda of Government and sustain the post COVID-19 recovery.

Our goal now is to significantly enhance revenues, significantly cut down the cost of running government, significantly expand local production, invest more to protect the poor and vulnerable, continue expanding access to good roads, education and health for every Ghanaian everywhere in Ghana and the diaspora.

Public Debt Developments for January – September 2022 46.

The thrust of the external sector will focus on rebuilding external buffers enough to cover at least three and half months of imports of goods and services to cushion the economy against adverse external shocks.

As a first step, however, the headline rate will be reduced to one percent (1%) of the transaction value alongside the removal of the daily threshold.

Mr.

Speaker, consistent with the private sector-led approach, the programme will engage interested private sector actors to expand and agricultural production and processing in the Asutuare-Tsopoli Economic Enclave area based on a Partnership Framework.

Mr.

Speaker, in addition to the Automotive Assembly Programme, Government has developed a new Components Manufacturing Policy which seeks to support the local production and supply of components and spare parts for the automotive industry.

Mr.

Speaker, this initiative which seeks to expand our production and productivity in rice, tomato, maize, vegetables and poultry is being led and coordinated by the Millennium Development Authority (MiDA) in collaboration with other Government institutions such as the Ministry of Food and Agriculture (MoFA), Ministry of Energy, Ghana Irrigation Development Authority (GIDA), 48 Engineers Regiment of the Ghana Armed Forces (GAF) under the Ministry of Defence, the National Entrepreneurial and Innovation Programme (NEIP) and the National Service Secretariat (NSS).

Overall Real GDP to grow at an average rate of 4.3 percent; ii.

Mr.

Speaker, in addition to the Enclave Project, GhanaCARES programme in 2023 will continue to offer catalytic support in the following targeted areas.

To achieve these, there are three (3) critical imperatives: successfully negotiating a strong IMF programme; coordinating an equitable debt operation programme; and attracting significant green investments.

To this end, Government will target these products for import substitution by supporting the private sector, through partnerships with existing and prospective businesses to expand, rehabilitate and establish manufacturing plants targeted at producing these selected items.

The depreciation of the Ghana cedi added GH¢93,855.15 million to the external debt stock.

Mr.

Speaker, the following projections underpin the resource allocation for 2023: • Compensation of Employees is projected at GH¢44,990 million (5.6% of GDP).

Government has also pursued cost-cutting and green initiatives, including conversion to a tolling model, refinancing of expensive debt, profiling of tariffs and switching power plants from imported liquid fuel to locally produced natural gas as primary fuel.

Mr.

Speaker, this Budget is, therefore, anchored on a seven-point agenda aimed at restoring macro-economic stability and accelerating our economic transformation as articulated in the Post-COVID-19 Programme for Economic Growth (PC-PEG).

Mr.

Speaker, the 2023 Budget, will focus on Government’s resolve to structurally transform the economy.

Mr.

Speaker, in fulfillment of Government’s commitment to improve road infrastructure, the Ministry of Roads and Highways continued its Nationwide Road and Bridge Construction Programme.

Non-Oil Real GDP to grow at an average rate of 4.0 percent; iii.

The sharp growth in the external debt stock is largely driven by the depreciation of the local currency.

Progress of the new bridge being constructed over River Pra to separate vehicular traffic from the rail along the Twifo Praso-Dunkwa road is at 87 percent completion.

On average, Ghana’s import bill exceeds US$10 billion annually and is accounted for by a diverse range of items that include iron, steel, aluminum, sugar, rice, fish, poultry, palm oil, cement, fertilizers, pharmaceuticals, Toilet roll, toothpick, fruit juices, etc.

At COP27, the Government took the opportunity to leverage its bilateral engagements to expand consultations on debt-for-nature swaps as well as increased private sector investments to accelerate our transition to low carbon growth and finance our climate action measures.

Mr.

Speaker, data on the performance of the economy at the end of the third quarter highlights the continued adverse impact of the challenging global and domestic environment on the economy.

However, what started as a political disagreement over revenue measures in this House, triggered a series of events that significantly undermined the credibility of our budget, consequently leading to serious economic challenges, as investor confidence hit a new low.

• Mr.

Speaker, Other Expenditure, mainly comprising Energy Sector Levies (ESL) transfers and Energy Sector Payment Shortfalls is estimated at GH¢26,739 million.

Construction of the Kumasi Lake Roads and Drainage Extension project is almost complete and stands at 97 percent.

Mr.

Speaker, the Livelihood Empowerment Against Poverty (LEAP) Programme has since its inception in 2008, supported extremely poor and vulnerable households; increasing beneficiary coverage from 143,552 in 2015 to 344,389 households comprising 1,827,035 individuals as of September 2022.

Mr.

Speaker, Government will continue to strengthen monitoring to address teething challenges in the implementation of the policy which include; timely release of the grant, misuse of funds, transparency and poor book keeping and value of grant amount.

The corresponding primary balance for the period was a deficit of GH¢11,921 million (2.0% of GDP), against a deficit target of GH¢5,794 (1.0% of GDP).

Inflation to be within the target band of 8±2 percent; iv.

End-December inflation rate of 18.9 percent iv.

Provision has also been made in the 2023 and the Medium-Term Budget for the Equity and Viability Gap Funding required by a GIIF Special Purpose Vehicle (SPV) to enable the project to start in earnest in 2023.

Mr Speaker, I beg to move that this House approves the Budget Statement and Economic Policy of the Government of Ghana for the year ending December 31, 2023.

It covers public, publicly guaranteed debt of central government and partial non-guaranteed debt of SOEs.

I request the Hansard Department to capture the entire Budget Statement and Economic Policy of Government for the year ending December 31, 2023.

Overall Real GDP growth of 2.8 percent; ii.

In 2023, Government will intensify support to existing and new manufacturing enterprises with technical assistance, credit facilitation, and access to electricity and other infrastructure.

The current debt sustainability analysis conducted reveals that Ghana is now considered to be in high risk of debt distress.

Mr.

Speaker, the year 2022 will go down as one of the most difficult and eventful years in the economic history of our country.

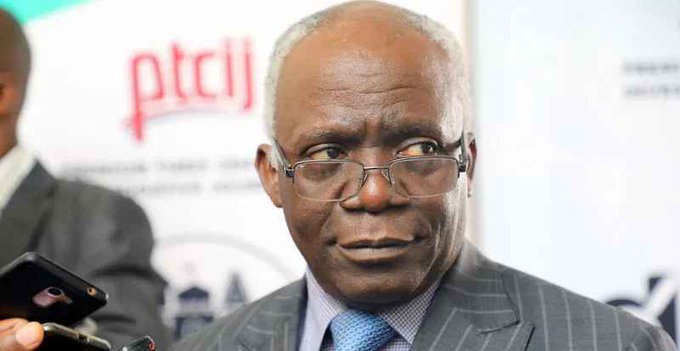

Finance Miniter, Ken Ofori-Atta delivered the country's budget for 2023 to Parliament on Thursday, November 24, 2022.

Mr.

Speaker, despite the heightened debt levels, Government remains committed to ensuring that debt is brought to sustainable levels over the medium to long-term.

I wish to assure this House of my strong commitment and unflinching cooperation in our collective efforts to secure a historic IMF programme very soon; a programme that will assist the country in its post-covid recovery efforts.

Mr.

Speaker, I now present to this august House the provisional macroeconomic performance for the first three quarters of 2022 based on available data for the period.

Works on Phase II of the Obetsebi Lamptey Circle Interchange and ancillary work is at 71 percent completion.

Mr.

Speaker, since Government announced its engagement with the International Monetary Fund (IMF or the Fund) for a supported Programme on 1st July, 2022, we have made substantial progress.

On the revenue side, some of the measures that will be identified for the Medium Term Revenue Strategy being designed by Government in the context of the IMF programme could be implemented early on.

We urgently need to restore debt sustainability, macro- economic stability and grow the economy.

Mr.

Speaker, as part of effort to ensure power is affordable for industrial, commercial and residential use, Government has substantially completed a renegotiation and restructuring exercise of Power Purchase Agreements (“PPAs”) with 6 operational Independent Power Producers (“IPPs”), namely, Karpower, Cenpower, Early Power, Twin City Energy (formerly Amandi), AKSA Energy and CENIT Energy.

We are confident that the measures outlined in this 2023 Budget will redirect us on the path of macroeconomic stability and growth.

Non-Oil Real GDP growth of 3.0 percent; iii.

Similarly, the Ghana cedi depreciated cumulatively by a 48.5 percent against the British Pound.

Mr.

Speaker, in this Budget, we have highlighted the need for robust public sector reforms to complement the existing public financial management regime.

Since August 2022, the Bank of Ghana has successfully been working with the mining firms, international oil companies, and their bankers to purchase all foreign exchange arising from the voluntary repatriation.

Mr Speaker, this Budget Speech is an abridged version of the 2023 Budget Statement and Economic Policy of Government.

According to the World Bank Group’s new Country Climate and Development Report (CCDR) for Ghana, incomes could reduce by up to 40% for poor households by 2050, if urgent climate actions are not taken.

Works on the interchange currently stand at 62 percent.

Additionally, construction of the Flyover over the Accra- Tema Motorway from the Flower Pot roundabout is 56 percent complete..

Read Full Story